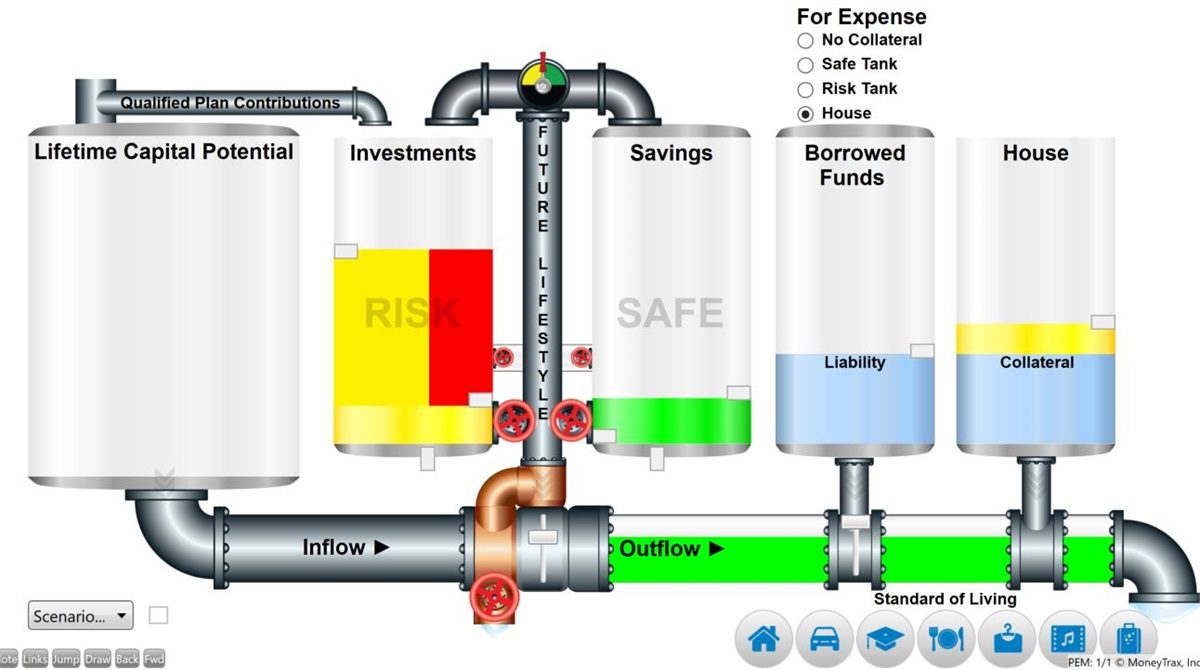

One of the communication tools we use when discussing retirement plans is the Personal Economic Model®. Much as a medical doctor would use an anatomical model to convey medical concepts, we use this model to convey financial concepts.

This model offers a visual representation of the way money flows through your hands. On the left, you will notice the Lifetime Capital Potential tank which represents all the money you will earn during your lifetime. It is substantial and also finite. Once earned your money flows directly to the Tax Filter where the state and federal governments extract tax dollars due from earnings on your monthly cash flow. The after-tax balance is then directed to either your Current Lifestyle or your Future Lifestyle determined by your management of the Lifestyle Regulator. Determining the balance of cash flow between your current lifestyle desires and your future lifestyle requirement may be the most important financial decision you will ever make.

Here is why.

Each and every dollar that is allowed to flow through to your Current Lifestyle is consumed and gone forever. The goal is to accumulate enough money in the Savings and Investment tanks so that by the time you retire, the dollars in those tanks can then be used to satisfy your future lifestyle requirements. Position A would be to have enough in the tanks to live like you live today adjusted for inflation and have your money last at least to your life expectancy. That is a win, but the icing on the cake would be to accomplish that with little to no impact on your present standard of living, and that is exactly what we strive to help our clients to do.In working together, we can help you to address the following:

- Optimize the balance between your Current and Future Lifestyles

- Improve efficiency in your current personal economic model

- Design, implement, and execute a plan to secure your financial future

- Limit the impact on your Current Lifestyle dollars (maintain your current standard of living)